Keep Your Money to Use it Now

Keep your Money!

“It is not how much money you make, It’s how much money you keep.” This powerful saying has stuck with me for a long time throughout my career. I believe most people are making more than they are actually taking home. Don’t you wish you had just 75 more dollars each paycheck? Good news is more than likely do, you just need to keep your money! Let me explain.

First Things First!

Assess your situation and call a CPA. I know that you probably use turbo tax or something a little cheaper, but for most people who are married, with two kids, and two jobs your tax situation is not that complicated resulting in the CPA not costing that much. Another benefit of having a personal CPA is that you can pick up the phone and call them if you have any questions about tax benefits. Again, for most people the questions that you have now are something that can be answered in 1 minute and, honestly, your CPA will thank you because you asking these questions will keep you more prepared come tax season. Which brings me to…..

TAXES!

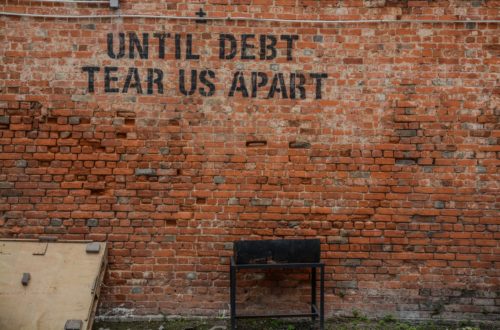

Ugh! Yes, taxes are a must and everyone has to pay them. But you get a huge refund check at the spring of every year right? Well you should not get that refund check! If anything, you should owe just a little. “But Dean, why would I want to give the gov more money?” Because, you need to KEEP YOUR MONEY today! Some quick (rough) math, if you get a federal refund check of $1800, that means that you gave the federal government and extra $150 per month of your money. You need to keep your money! Have credit card debt that is costing you on average 17% interest rate? Get that paid off with that $150 dollars a month. Have student loan debt? Get ahead of it with your extra $150 dollars a month and pay it off early! Your credit score will thank you! Have a mortgage? Get ahead of it by paying $150 extra dollars a month! You will take a 30 year mortgage and lower it by several years and more importantly save thousands of dollars in interest! Or if your student loans, credit card, and mortgage are ok, move the extra money to your 401K and let it make money for you! Your 401k needs two things to grow, capital and time. Don’t lose your capital by giving it to the government in the form of taxes. Even if you put your entire refund check into your investments, you have already lost a whole year that you will never get back! When you retire you will be extremely happy you maximized your 401K! Again, you need to KEEP YOUR MONEY! Get with your CPA and discuss options, also be sure to ask about Tax Brackets!

Insurance!

Insurance is something that is a burden until the day you need it, then it was worth every penny. I always recommend getting something above the basic package for insurance, just in case! But that does not mean that you need to pay for it. Insurance is another opportunity to KEEP YOUR MONEY! Many employers offer benefits that help lower the amount of money you have to pay in. These include gym memberships, having check ups, wearing a fit-bit or apple watch, or getting blood drawn. Talk to your HR department to see if you can take advantage of these options. Also, now this depends on your current situation, instead of asking for raise, ask to have your insurance fully covered. You may actually come out ahead!

Action Steps

Use the following steps to keep your money!

- Asses your current situation and gather all your information

- Find a local and trusted CPA that is easy to communicate with during business hours

- Once you have a plan, go to your HR department and set it up so you have less federal taxes coming out

- Discuss with your HR department any actions you can take to lower your insurance rate without sacrificing coverage.

- Deploy your newly found money to help get yourself out of debt by paying off Student Loans, mortgages, car payment. Or use it to better set yourself up for retirement or use it to start funding for your childs future education.

REMEMBER – Keep Your Money

Stay disciplined! Just because you have more money does not mean you can spend it on consumer debt! Wasting it on Starbucks, unnecessary eating out, or sporting event tickets is actually WORSE than having it come out in taxes! Stay disciplined, use a financial planner, and build yourself a better life! Trying to decide on what to do with your money, check on my blog on removing debt and why you should do it.